A small enterprise doesn’t have to file a separate tax return if it’s arrange as a sole proprietorship or an LLC taxed as a sole proprietorship. Earnings from the enterprise is included on a Schedule C within the proprietor’s private tax return. A revocable residing belief is a “disregarded entity” below federal tax regulation. Earnings in a revocable residing belief is handled as earned by the grantor.

Separate Tax Returns and Ok-1s

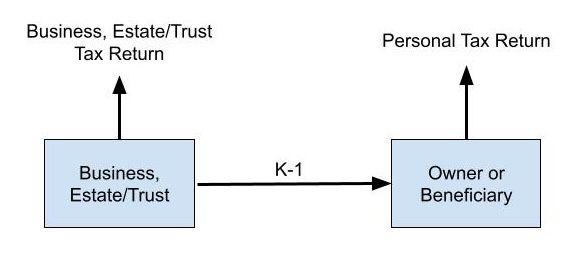

If the enterprise is about up as a partnership, an S-Corp, or an LLC that chooses to be taxed as an S-Corp, it should file a separate tax return and difficulty a Schedule Ok-1 to the proprietor(s). An irrevocable belief or an property should additionally file a tax return for itself and difficulty a Schedule Ok-1 to the beneficiaries. The proprietor or the beneficiary then consists of earnings and deductions from these Ok-1s on their private tax return.

Some tax software program merchandise marketed to customers have a “Residence and Enterprise” or “Self-Employed” version, however the “enterprise” or “self-employed” part solely refers to Schedule C. These shopper tax software program will settle for Ok-1s issued by a enterprise, a belief, or an property as inputs, however they don’t produce the tax return for an irrevocable belief or an property, a partnership, an S-Corp, or the related Ok-1s.

You’d have to purchase a separate product if it’s essential file Type 1041 for a belief or an property, Type 1065 for a partnership, or Type 1120-S for an S-Corp. Software program that generates these tax returns is costlier than software program for private tax returns. TurboTax Enterprise sells for $134 on Black Friday (the record worth is $190). TaxAct Enterprise sells for $140 to $165. These enterprise tax software program merchandise are utterly separate from the common TurboTax or TaxAct. They don’t embody private tax returns.

H&R Block is an exception. Its Premium & Enterprise version can do each private tax returns and enterprise or belief/property tax returns. You should buy it for as little as $50 when it’s on sale at Amazon, Newegg, or Walmart. Contemplating that H&R Block’s Deluxe + State version, which solely does private returns, sells for $30 when it’s on sale, you solely pay $20 further for the enterprise program. Even when you use one thing else in your private return, paying $50 solely to make use of the enterprise portion of the software program continues to be quite a bit inexpensive than the options.

This put up isn’t sponsored by H&R Block or anybody else. I’m solely writing as a person of this software program since 2018.

Two Apps in One Package deal

H&R Block Premium & Enterprise installs two distinct apps on the pc: H&R Block Premium and H&R Block Enterprise. H&R Block Premium is the traditional software program for private tax returns. It supposedly consists of extra options than the Deluxe + State version, however I don’t see a lot distinction. H&R Block Enterprise is the software program for enterprise and belief/property returns. It’s a separate app developed by ATX for H&R Block. ATX, owned by Wolters Kluwer, makes skilled tax software program for CPAs and tax preparers.

These two apps don’t work together with one another immediately. You’ll take the Ok-1s produced by H&R Block Enterprise and enter them into H&R Block Premium or one other software program you employ in your private tax return.

H&R Block Enterprise works, however as a result of ATX primarily makes software program for tax professionals who know what they’re doing, the software program doesn’t embody a lot handholding. There’s an interview, as in typical private tax software program, however there isn’t a lot clarification when you don’t perceive the query. It feels such as you’re simply filling out tax types one half at a time.

If in case you have a easy return or you possibly can reference a prior-year return completed elsewhere, the software program does its job. You possibly can e-file the federal 1041, 1065, or 1120-S, in addition to the state return for a handful of states, or you possibly can print and mail. If it’s essential create each a enterprise return and a belief return, the identical software program can do each. I don’t see any restrict on what number of returns you possibly can generate in H&R Block Enterprise.

I’ve used H&R Block Enterprise for a number of years. Listed here are some notes for brand new customers:

Home windows Solely

H&R Block Premium for private tax returns usually has each a Home windows model and a Mac model. Nevertheless, as a result of H&R Block Enterprise solely works on Home windows, the Premium & Enterprise bundle solely has a Home windows model. You want a Home windows machine to make use of H&R Block Enterprise.

ARM Processor Not Supported

Moreover, H&R Block Enterprise 2025 doesn’t run on a machine with an ARM processor, as a result of it makes use of RavenDB, which doesn’t work on Home windows ARM64. This implies you possibly can’t run it in an ARM-based Home windows digital machine on a Mac with Apple Silicon. The 2024 and earlier variations didn’t have this limitation.

Most Home windows PCs don’t use an ARM processor, but when yours does, it’s essential discover a totally different laptop to run H&R Block Enterprise 2025.

Run as Administrator

H&R Block Enterprise 2025 requires working as an administrator on Home windows 11. Once more, the 2024 and earlier variations didn’t require it. If you happen to get an error launching H&R Block Enterprise 2025 as a regular person, right-click on the shortcut and choose “Run as Administrator.”

Backup Return

H&R Block Enterprise retains your tax return knowledge in a neighborhood database. If you’re completed with a return, it is best to create a backup by exporting the information to a file. The exported backup file could be learn solely by the software program for a similar tax yr. As an example, you export a backup file myreturn.atx25Export with the 2025 software program. This backup file can solely be learn by the 2025 software program.

This YouTube video exhibits tips on how to export a backup and restore from a backup:

Save the Installer

If you set up H&R Block Enterprise 2026 on the identical laptop subsequent yr, it might discover the 2025 knowledge within the native database and import it for 2026. It doesn’t use the exported backup file. Nevertheless, when you swap to a brand new laptop and set up the 2026 software program, it might’t import from the 2025 backup file. You might want to set up the 2025 software program as properly on the brand new laptop and restore from the 2025 backup file. Then the 2026 software program will discover the 2025 knowledge to import.

Due to this fact, don’t delete the unique installer after you put in the software program. You’ll want it once more when you swap computer systems. Save the installer and the activation code along with the exported backup for annually.

Type Launch Dates

As with private tax software program, some tax types develop into accessible solely later within the tax season. ATX updates this internet web page with the estimated launch date for every kind:

https://taxcut.atxinc.com/taxcutformsstatus.aspx

Bookmark it and examine when every little thing you want will probably be accessible.

***

H&R Block Enterprise isn’t as user-friendly as tax software program for private tax returns, but it surely’s professional-grade when it comes to its capabilities. Tax professionals cost a whole bunch of {dollars} and up for enterprise and belief tax returns. It’s value making an attempt DIY with cheap software program if in case you have a easy return or there are not any main adjustments from final yr. There’s a studying curve for something new, however you’ll have a way of accomplishment while you end.

Study the Nuts and Bolts

I put every little thing I exploit to handle my cash in a ebook. My Monetary Toolbox guides you to a transparent plan of action.